Yuan Gains Momentum in China-Russia Commodities Trade

The Lede: In the past year China has substantially increased its use of the yuan to buy Russian commodities. Multiple trading executives, who are directly involved in the matter, have informed Reuters that nearly all of China's acquisitions of oil, coal, and certain metals from China are now settled in yuan, signaling a shift away from the traditional reliance on the U.S. dollar.

What we know:

- Following the wave of Western sanctions after Russia invaded Ukraine, Chinese buyers took advantage of discounted prices to purchase crude oil, coal, and aluminum, resulting in a noteworthy 52% increase in commodities imports from Moscow in 2022, totaling $88.3 billion.

- In April, China witnessed a remarkable 153.1% surge in exports to Russia, amounting to $9.6 billion. This increase followed the rapid upward trend in March when exports grew by 136.4%, a significant leap compared to the 19.8% growth recorded during the first two months of the year.

- According to five trading executives who are directly involved in the matter, almost all of China's oil imports from Russia, which primarily consist of crude oil with smaller quantities of fuel oil, are now being settled in yuan. Reuters reported that the sources refused to be named because the issue is very sensitive.

- In March the Chinese yuan surpassed the U.S. dollar in terms of usage for cross-border transactions within China.

The background: Beijing initiated efforts more than ten years ago to promote the internationalization of the yuan. The process gained momentum in the years following the global financial crisis of 2008 when China sought to increase the currency's role in international trade and finance. The Chinese government implemented various measures to promote Renminbi (RMB), including expanding its offshore market, establishing clearing and settlement systems, and fostering bilateral currency swap agreements with other countries. But RMB has been limited in its usage for significant Chinese commodities transactions. This is primarily because most of the global trading involving oil, gas, copper, and coal is priced based on dollar-denominated benchmarks.

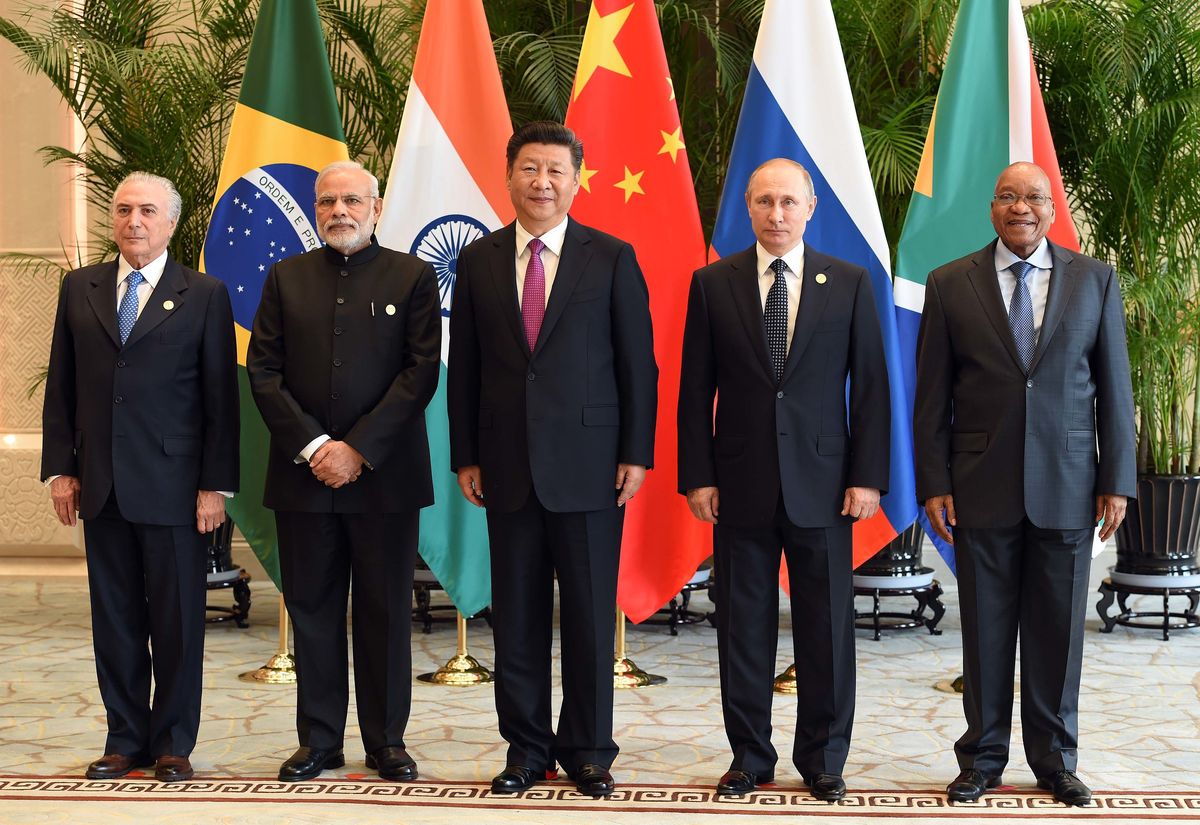

As the Kremlin's invasion of Ukraine unfolded, China and Russia ramped up their joint efforts to challenge the long-standing dominance of the U.S. dollar. This strategic collaboration between China and Russia serves as a means for both nations to assert their economic and geopolitical interests while challenging the established global monetary order. For Russia, it’s a way to mitigate the impact of Western sanctions through alternative sources of trade. These sanctions include measures aimed at lowering Russian oil prices and imposing restrictions on shipping, insuring, and purchasing it. In a collective effort, the Group of Seven (G-7) industrial nations, agreed to impose a maximum cap of $60 per barrel on traders operating within their countries.

Meanwhile, China has supported its post-COVID economic recovery and has further expanded the use of the yuan with one of its top strategic partners. In April the Chinese yuan surpassed the U.S. dollar and emerged as the dominant currency in terms of trading volume in Russia.

Likely outcomes/Takeaway:

- This shift can potentially enhance China's economic influence by strengthening its ties with Russia and establishing a closer financial relationship between the two countries. It also contributes to the broader objective of increasing the global usage of the yuan, which aligns with China's aspirations to position its currency as a viable alternative to the U.S. dollar in international trade and finance.

- Chi Lo, Senior investment strategist at BNP Paribas Asset Management in Hong Kong wrote in April that increased use of the yuan holds the potential to advance China's aspirations of establishing it as a global currency. In the last couple of months, Beijing has made deals with a couple of countries to use yuan in trade, including Russia, Brazil, and Argentina. Others like Syria have signaled readiness to join the trend. Chi Lo refers to China’s approach as "salami-slicing tactics," aimed to gradually diminish the dominance of the U.S. dollar, but unlikely to fully replace it. The reason is that most of these countries will still use the dollar in trade with nations other than China.

- He also wrote that currently, the greatest hindrance to the RMB's global currency status is China's restricted capital account, which limits its convertibility. A crucial factor for the RMB to be widely accepted as a global reserve currency is for China to establish global credibility and earn international trust – and, achieving this feat is anticipated to be a long and gradual process.

Quotables:

- “Its ‘salami-slicing tactics’ for internationalizing the currency will likely slowly erode the dollar’s prominence in the medium term, but the Chinese currency is unlikely to replace the dollar completely... Once renminbi use becomes more widespread, a payments system parallel to the U.S. dollar system could gain critical mass, setting up the technical, regulatory, and institutional frameworks to accommodate a more ubiquitous renminbi over time.” – Chi Lo, Senior Investment Strategist at BNP Paribas Asset Management.

- “The problem is not the cooperation with China itself, but that Russia has replaced multiple trading partners with only one player.” – Natalia Lavrova, Chief Economist at BCS Global Markets as told to the Financial Times.

- “We are for the use of the Chinese yuan in settlements between Russia and Asian countries, Africa, Latin America... This practice should be further encouraged.” – Russian President Vladimir Putin.

Good Reads:

Russia embraces China’s renminbi in face of western sanctions (The Financial Times)

Russia and China Step Up Effort to Challenge Dollar with the Yuan (The China Paper)

Vast China-Russia resources trade shifts to yuan from dollars in Ukraine fallout (Reuters)