Russia and China Step Up Effort to Challenge Dollar with the Yuan

The Lede: As Beijing seeks to bolster the yuan as a common currency in a challenge to the dominance of the U.S. dollar, Moscow may have found its alternative after being banned from Western financial networks. The China-Russia economic partnership may suggest a burgeoning central currency set to rival the dollar standard as more trades are made in yuan.

The China Paper believes the war in Ukraine has supercharged efforts that were already underway to create a rival to the petrodollar and believes news media are catching on to the currency arena as an increasingly important part of the story of how western democracies are aligning themselves to compete against more authoritarian governments for economic dominance.

What We Know

- Dedollarization has been a priority for Russia since 2014 when Western countries first placed economic sanctions on Moscow after the annexation of Crimea.

- The U.S. and its allies have been seeking to starve Russia of the funds needed to finance its war in Ukraine by using economic sanctions, with Russian crude oil being a key target. The western allies also cut off some key Russian banks from SWIFT, the global bank messaging system.

- The unrivaled liquidity and reliability of the United States monetary system and markets ensure treasuries around the world will park large portions of their reserves in dollar-denominated investments.

- Chinese president Xi Jinping makes no secret of wanting to encourage the world to use the yuan – also known as the renminbi – as the settlement currency of choice for global trade. At a Gulf summit in Riyadh in December, he called for oil to be traded in yuan.

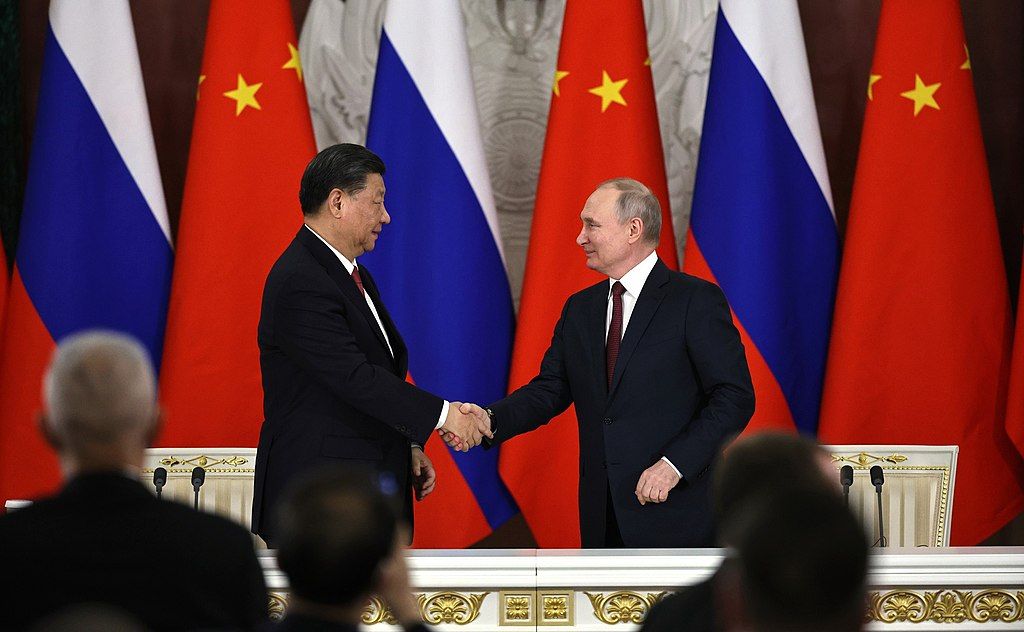

- Putin said as much during talks with Xi in Moscow on March 21. “We are for the use of the Chinese yuan in settlements between Russia and Asian countries, Africa, Latin America,” he said, according to the RIA Novosti news service and reported by the South China Morning Post. He added, “this practice should be further encouraged.”

- A big component of the western sanctions against Russia is the application of downward pressure on Russian oil prices and restricting who may ship, insure and buy it. The Group of Seven industrial nations agreed last year to a $60 per barrel cap that applies to traders in G-7 countries and Australia.

Takeaway/Possible Outcomes

- There is a dearth of trade reporting available to the public, but stories are beginning to surface in the news media that commodity traders, some of them large, well-known and connected to the west, are brokering Chinese purchases of Russian crude oil outside sanctions set by the G-7.

- Among the handful of outlets publishing stories about this trading activity, there are none reviewed by The China Paper that accuse the trading firms of any outright sanction violations. But Global Witness, a human rights advocacy group argues that the trade cap is ineffective and that Putin is still able to fund his military incursion into Ukraine.

- That report, and at least a couple of stories in major news organizations, seek to shine light on the business infrastructure that facilitates the sale of Russian oil – much of it to Chinese customers – despite western attempts to cut off Russia’s economy from the rest of the world and to exert downward pressure on oil prices in part to minimize Russian profits. All the companies cited in news reports have disavowed any wrongdoing.

- A company based in Switzerland, Paramount Energy and Commodities, S.A., was singled out in a Financial Times story that suggested its founder, Niels Troost, had ties to continued oil trade with Russia through a nearly identical-named entity domiciled in the United Arab Emirates. The London paper steered clear of saying that Troost or the company he founded was engaging in any wrongdoing, but it reported that the Swiss company ceased its Russian crude trading activity around June when the price cap was being discussed by the G-7, and that shortly after that trading “was taken up by a near-identically named company in Dubai” named Paramount Energy and Commodities DMCC.

- The FT article prompted a U.S. law firm representing Geneva-based Paramount, S.A., to warn the newspaper that it “risked supporting a campaign by unnamed people to ‘extort’ the company if it published them.” (see Quotables) The FT made the warning part of the story rather than back off. Days later, an Italian newspaper, Italy News Daily, picked up much of the same story. The reports about the two companies named Paramount have not caught on widely, but the overarching story of companies, mostly based in Asia, carrying on trade in Russian crude outside western sanctions, is beginning to take shape.

- Recently, widely-syndicated columnist Fareed Zakaria wrote in an editorial that he was concerned that the unchallenged might of the U.S. dollar, the nation’s “superpower” he called it, is being undermined by China and Russia. Zakaria by no means said the dollar’s replacement as the world’s de facto trade currency is imminent, but he is the latest and perhaps the most prominent observer to sound an alarm over what one think tank called “dedollarization.” Zakaria joins a growing chorus in saying that any usurpation by the Chinese yuan or any other currency won’t happen overnight if at all, but it’s time for Americans – especially policymakers – to start considering the consequences of dedollarization and the severe reckoning that would ensue.

Quotables

“The dollar is America’s superpower. It gives Washington unrivaled economic and political muscle. The United States can slap sanctions on countries unilaterally, freezing them out of large parts of the world economy. And when Washington spends freely, it can be certain that its debt, usually in the form of T-bills, will be bought up by the rest of the world." – Fareed Zakaria, in an op-ed for The Washington Post

“In an initial response to questions sent to Troost about certain ESPO (Eastern Siberia-Pacific Ocean) shipments, Paramount SA’s lawyers, US firm BakerHostetler, dismissed points presented by the Financial Times as ‘incorrect in all material aspects’. The law firm warned the FT that it risked supporting a campaign by unnamed people to ‘extort’ the company if it published them.” – Tom Wilson and David Sheppard in London, in the Financial Times.

“Western companies trading Russian oil did not break sanctions by dealing with Russia from the beginning of the war. But those that continued trading chose to cash in on skyrocketing prices caused by the invasion, as a result of enabling Putin to build up the Kremlin’s war chest.” – Global Witness.

“Some oil traders have been willing to take on the reputational and legal risks of continuing the lucrative business with Russia when better-known companies have been deterred.” – Financial Times, March 20

Good Reads

The dollar is our superpower, and Russia and China are threatening it (Washington Post)

Two companies, one trade: the switch that keeps Putin’s oil flowing (Financial Times)

One year on: Western companies traded 533 million barrels of Russian oil (Global Witness)