German Central Bank and Leadership Pin Economic Woes on China Dependence

The Lede: On Monday, the Bundesbank issued a warning in its monthly report that identifies excessive dependence on trade with China for Germany’s weakening economy and recommends cutting exposure of business operations in the country. This echoes Germany’s new China strategy as emphasized by the country’s leadership and comes as the EU Commission launches an investigation into Chinese electric vehicle subsidies.

What We Know:

- The monthly report emphasizes that 29% of German companies import essential materials and parts from China, which exposes them to potentially significant damage in the case of disruptions to trade routes caused by intensifying geopolitical rivalries

- Germany’s central bank also blamed high energy prices and labor shortages for the country’s poor economic outlook. The IMF has predicted that Germany will be the worst-performing major economy in 2023 with a forecast for growth to shrink by 0.3 percent.

- Some recommendations from the Bundesbank include securing more free trade agreements to diversify away from China as well as improved integration of immigrants into the labor market and a speeding up of state bureaucracy.

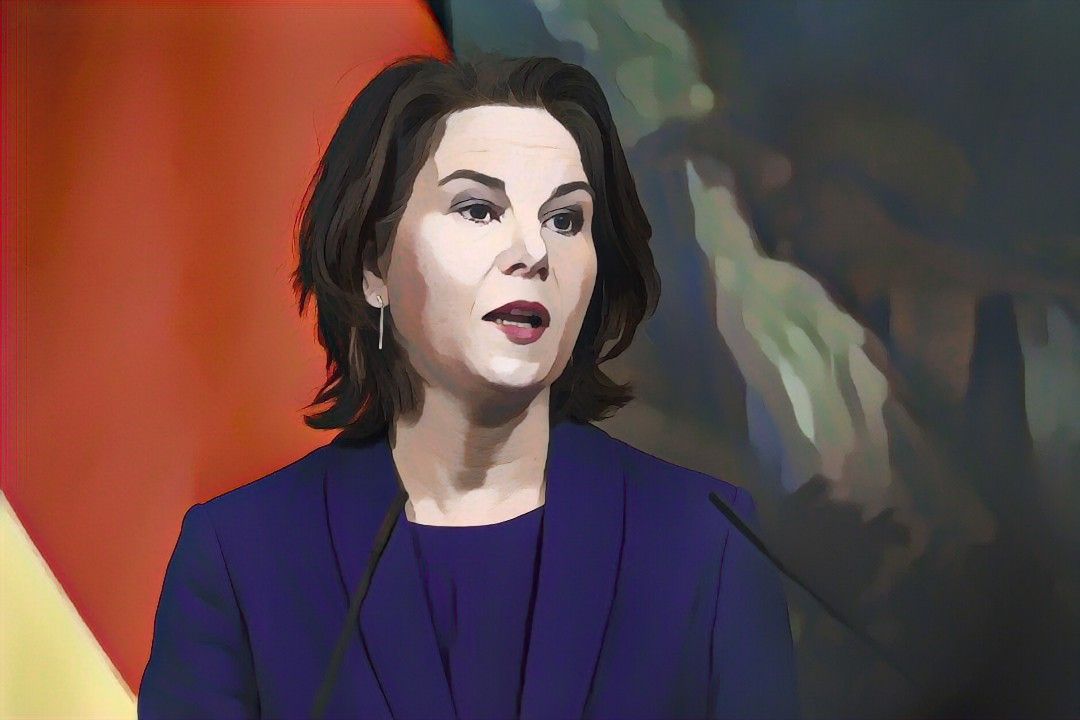

- German foreign minister Annalena Baerbock and Chancellor Olaf Scholz both expressed similar sentiments last week. Scholz pointed to the weakening of Germany’s export markets, especially China. He also addressed the issue of energy by pointing to the government’s expansion of wind and solar power but acknowledged the obstruction of excessive bureaucracy.

The Background: Germany adopted a new China strategy in July. Like the new report from the Bundesbank, it recommends that the country’s companies should reduce their dependence on China and warns that the government would not come to the rescue in the event of losses incurred from these geopolitical risks. China is an important market for German cars and machinery, but exports to China are dwarfed by its imports from China.

Likely Outcomes:

- The continued rhetoric of pinning Germany and Europe’s economic problems on the Chinese market led to Baerbock labeling Chinese President Xi Jinping a ‘dictator’ in passing during an interview, which the Chinese government responded negatively to. As this narrative takes hold, these kinds of remarks may become more commonplace and contribute to souring ties.

- If German companies have held out hope that interactions with the China market could continue, these most recent reports and remarks serve as clues from policymakers that these ties will be strongly discouraged and will likely entail significant downside risks moving forward. These businesses may conclude that the uncertainty is not worth bearing and shift operations accordingly. Scholz’s meeting with Indonesian President Joko Widodo at this year’s Hannover Fair in Germany may be a hint that Southeast Asia could be a destination for German and European businesses.

- Chinese business interests in Germany will likely focus on the industries that it sees as less sensitive and maintain those linkages. Otherwise, it is likely that no overly ambitious plans will be launched between the German and Chinese economies for the foreseeable future. China may instead look to the handful of remaining European countries that do not share the ‘de-risking’ sentiment to such a high degree.

Quotables:

“The past few years have revealed the risk to economic development that comes from strong one-sided dependencies on primary products from abroad. There is still a need to reduce dependencies on China — especially for primary products that are very difficult to replace...A sudden unbundling from China would probably be associated with far-reaching disruptions to supply chains and production in Germany, at least in the short term. In view of increasing geopolitical tensions and the associated risks, it is necessary for companies and politicians to rethink the evolved structure of supply chains and the further expansion of direct investment in China.” – Bundesbank report, September 2023

Good Reads:

German companies must cut exposure to China, warns Bundesbank (FT)

Europe Must Cut Down on Its Dependence With China, Baerbock Says (Bloomberg)