China Announces Halt to Export of Rare Earth Processing Tech

The Lede: On Thursday, China announced plans to curb the export of key rare earth processing technologies against the backdrop of the U.S. and countries aligned with it seeking to organize supply chains outside of dependence on China. Rare earths are at the center of the increasingly tense rivalry with the West in the global transition to green energy.

What We Know:

- In the name of national security concerns, technologies for making rare earth magnets, ore mining, ore selection, and refining are among the items added by Beijing to a list of technologies that cannot be transferred from the country called the "Catalog of Technologies Prohibited and Restricted from Export."

- The new restrictions detailed in a document from the Chinese Ministry of Commerce are expected to have the biggest impact on so-called ‘heavy rare earths,’ which are used in electric vehicle motors, medical devices, and weaponry. The shipment of rare earth products themselves are not affected.

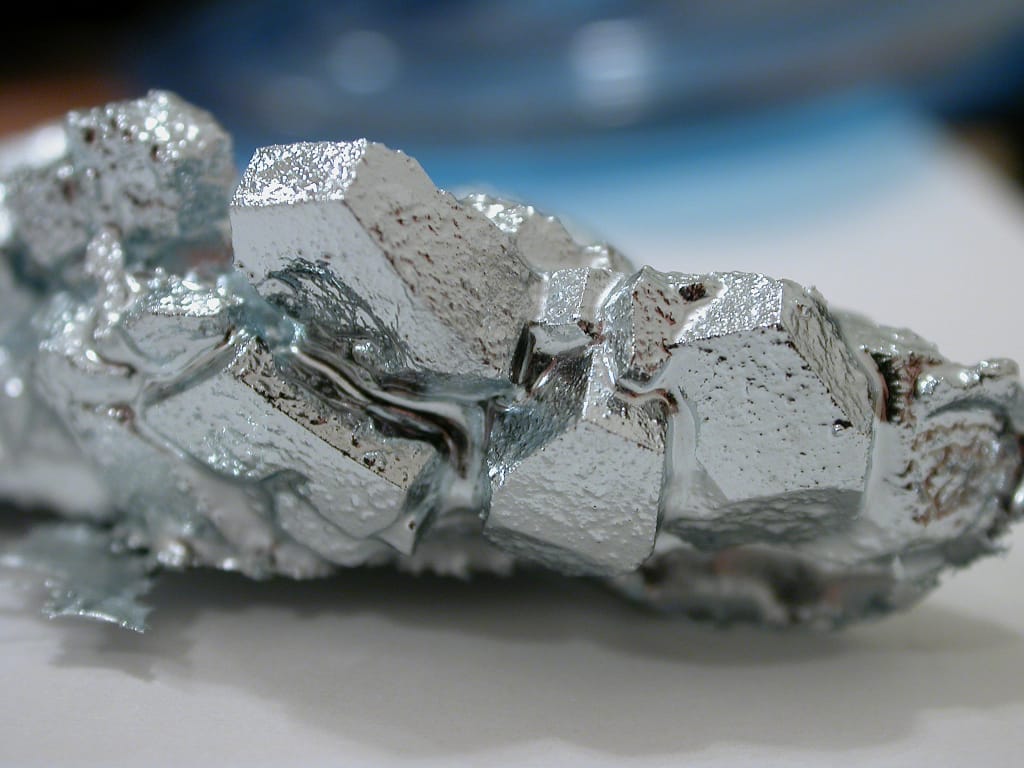

The Background: China currently separates a vast proportion of the world’s heavy rare earths and its production represents about two-thirds of global refined output. Western companies have not been able to overcome technical complexities and pollution concerns in refining processes. Rare earths include 17 soft heavy metals that possess properties that are useful in industry. These metals are plentiful in the earth’s crust, but are not found in concentrated deposits. Obtaining them requires sifting large amounts of raw material. Over the summer, China put export restrictions on gallium and germanium, which are used in computer chips and solar panels.

Likely Outcomes:

- This ban will likely highlight the tremendous difficulty that other countries will encounter in getting heavy rare earth processing capacity online outside of China. In the short term, China will likely remain the world’s dominant processor of rare earths. However, companies outside of China are likely to pursue the development of their own capacities and governments will probably perceive benefits of providing subsidies for those endeavors.

- The prices of all rare earth dependent technologies and products are likely to rise significantly if this policy effectively throttles the established supply chains. China likely wants to keep its production and market share intact, but retaliatory measures by other countries may arise and disrupt supply chains for processed rare earths. Western countries will have to juggle the pressures of their green transition goals and their economic and trade rivalries with China.

Quotables:

“China has a strong position in the global economy built up since the eighties. It is seeking to corner the market in clean tech as it does in other sectors like steel. We need to join the Americans, Japanese, and others, and work together to water down China’s leverage.” – Jack Richardson, an associate fellow at the Council on Geostrategy

“China said they would never introduce export restrictions on rare earths after 2011. The announcement appears to be a clear warning of its willingness to weaponize its dominant position in rare earths.” – Paul Atherley, chairman of Pensana

“The fact that there is a prospect of them using this weapon is very disturbing. It indicates the rise of the assertive confidence of China on the global stage and their sense that they can play these games.” – Brian Menell, chairman of TechMet

“It can be a nine, twelve, eighteen-month lead time when you are ordering this kind of equipment, because the companies that manufacture it don't sell thousands - they are done to order. So if there are folks who placed their orders a while ago and the kit is on its way on a boat or in a warehouse somewhere, there's going to be some concern now. Anyone who is relying on Chinese hardware, that's going to be an issue.” – Gareth Hatch, head of Strategic Materials Advisory

"This should be a clarion call that dependence on China in any part of the value chain is not sustainable." – Nathan Picarsic, co-founder of Horizon Advisory

Good Reads:

China Bans Export of Rare Earth Processing Tech Over National Security (VOA)

China Bans Exports of Some Rare-Earth Processing Technology (Bloomberg)

China blocks exports of rare earth technology after MPs warn Beijing is ‘weaponising’ supplies (The Telegraph)

China bans exports of rare-earth magnet technologies (Nikkei)

China ‘weaponising’ grip on vital rare earth metals (The Telegraph)