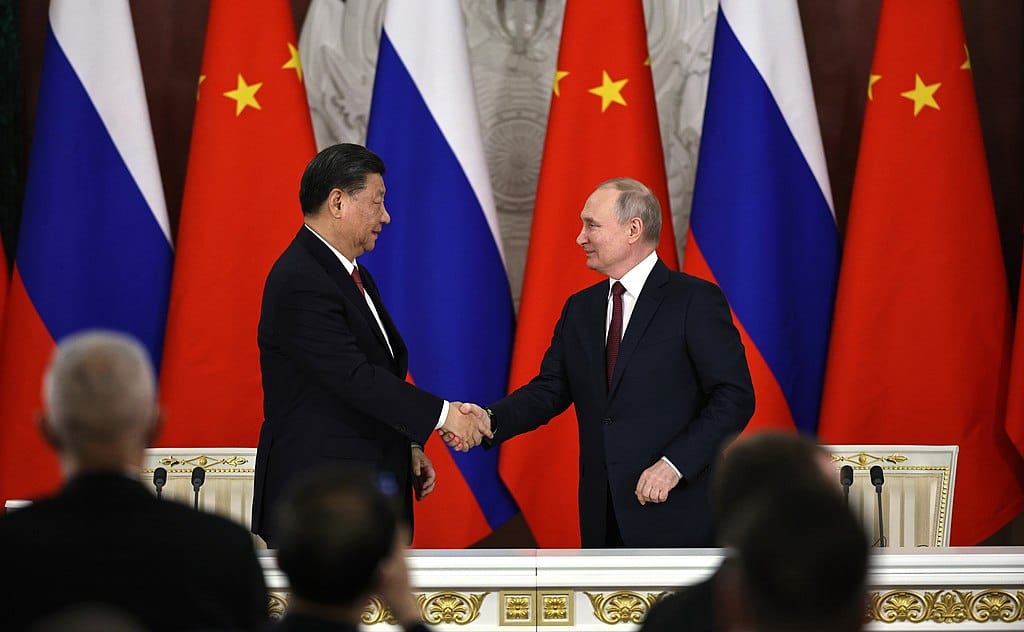

China Adds Boost of Confidence in Russian Market and Putin Leadership

The Lede: Nearly two years after Russia’s invasion of Ukraine, the country is showing signs of economic strength and stability as well as confidence in President Vladimir Putin’s leadership despite Western-led sanctions. This has been due in significant part to economic and political ties to China according to an opinion piece at the Washington Post, which highlights the interaction of the countries’ oil and auto industries.

What We Know:

- Russia has been experiencing packed restaurants, an enlarged domestic tourism scene, booming construction, and rising real estate driven largely by inward business prospects forced by Western sanctions. Against the backdrop of those sanctions that were expected to cripple the Russian economy and political class, Chinese interactions have been a significant force in shaping subsequent adaptations that have defied expectations by boosting market sentiments and attitudes toward the country’s leadership. China’s role in importing Russian crude oil and exporting Chinese car brands were among the most significant of these market dynamics.

- In the first half of 2023, China imported 2.13 million barrels per day of oil from Russia, ahead of 1.88 million barrels per day from Saudi Arabia. This has made Russia the top crude supplier to China so far this year, pulling ahead of Saudi Arabia. .

- According to Chinese customs data, Russia became China's largest export market for cars in the past year, reaching a value of $9.4 billion between January and October. It had been in 11th place previously with car exports to Russia amounting to $1.1 billion in the same period of last year. Chinese carmakers such as Haval, Chery, and Geely have been filling in the void left by Western counterparts that used to dominate the market before the war began.

- Data from Autostat reveals that monthly car sales in Russia are now more than double the amount from a year ago while Rosstat data shows that car production in the country was nearly three times higher in September year-on-year. Avtovaz, Russia's leading carmaker caters to the market for less expensive cars, while Chinese brands have been serving as the alternative for more expensive cars previously sold by Western producers.

The Background: China and Russia have grown closer politically and economically since the start of the war in Ukraine. The two countries have also strengthened cooperation under the BRICS group along with Brazil, India, and South Africa among a handful of new members added earlier this year. In April this year, it was found that China and a handful of other countries have been dramatically increasing their imports of Russian crude and selling oil products to Western countries that have sanctions on Russia. China and India accounted for 80% of Russian oil exports in July. Russian car production has been muted since the annexation of Crimea in 2014 and again with the outbreak of hostilities in Ukraine in 2022. Even with some support from Chinese companies, the lack of Western technology and expertise has weighed on the sector.

Likely Outcomes:

- Western sanctions on Russia will likely persist along with pressures on China led by U.S. foreign policy. The warm economic and political relations between Moscow and Beijing will probably coast along at this level for the foreseeable future as they form up against Western policies. However, it remains to be seen whether relations will progress further without another catalyst as tensions in the Middle East have come to the center stage again.

- Price policies and restrictions on Russian crude oil may be relaxed by Western policymakers and re-branded as a strategy to raise the price of Russian oil to reduce its competitive edge. China and India may well respond to such dynamics by cutting back, but may also consider ways to circumvent changing conditions with the relatively new practice of settling oil trades in Chinese yuan. At the same time, India has been encountering hiccups with settling Russian oil imports with yuan while the U.S. dollar remains the preferred settlement currency.

Quotables:

“Moscow is continuing to sell oil and gas to foreign buyers — not only China and India but European countries, too; most of these customers simply purchase Russian petroleum through intermediaries such as Turkey, Azerbaijan or Egypt. The West might have succeeded in cutting most of its ties with Russia, but Moscow’s trade with the rest of the world is picking up…Putin’s Russia can get many of the supplies it needs from China. For many Moscow residents, perhaps the most striking change on the streets is the near-wholesale replacement of Western cars with Chinese models.” – Mikhail Zygar, exiled Russian journalist and writer

“I don’t think China’s going to go all in on Russia. This is a short-term move away from Saudi feedstocks. The Chinese are pretty keen to keep a balance between their suppliers. It’s price-driven by market realities…One thing that isn’t appreciated in the west is how fierce competition is between the [Chinese] majors.” – Michal Meidan, head of China energy research at the Oxford Institute of Energy Studies

"The market has reached a state of equilibrium - the main Chinese [car] brands have come to Russia and (pent-up) demand is satisfied." – Sergei Udalov, executive director of Autostat

Good Reads:

Exclusive: Chinese car sales boom in Russia levels off amid shaky local recovery (Reuters)

Putin lauds ‘excellent’ economic ties with China. Here’s how they’ve grown (CNN)

China imports record volumes of Russian oil in first half of 2023 (FT)